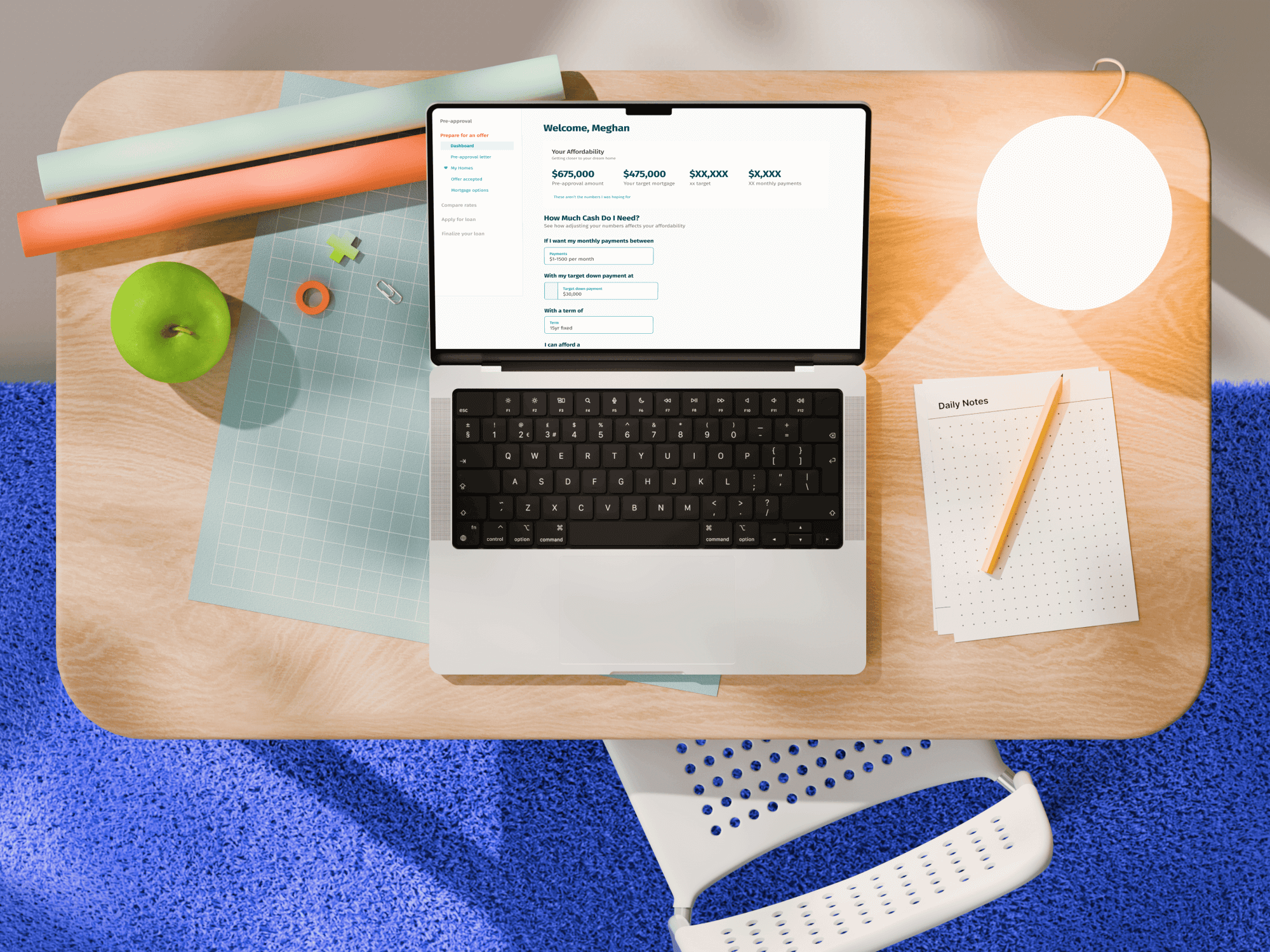

Credible: Helping First-Time Homebuyers Understand Their Purchase Power

Summary

Redesigned Credible’s mortgage pre-approval dashboard to simplify decision-making, personalize guidance, and build user confidence. The new experience reduced confusion, tailored next steps to buyer intent, and increased engagement across both early-stage “dreamers” and ready-to-act borrowers.

Focus: Clarity, personalization, and conversion

Role & Scope

Title: Lead Product Designer, Mortgage Experience.

I led the end-to-end UX strategy and redesign of Credible’s pre-approval dashboard, focused on improving clarity, personalization, and conversion. My work included:

- Stakeholder alignment across Product, Marketing, and Engineering

- User research with homebuyers and loan officers

- Usability testing and survey design

- Dashboard UX/UI redesign for different buyer intents

- Implementation of live analytics and behavior tracking to inform iteration

Design Challenge

Create a personalized dashboard experience that helps first-time buyers feel informed, supported, and empowered — whether they’re early “dreamers” or ready to purchase today.

Context

Credible offers a digital pre-approval experience that allows users to explore mortgage options without a hard credit check. After completing a three-step form covering property details, financials, and personal information, users receive a pre-approval estimate — a snapshot of their purchase power.

Upon completion, users landed on a dashboard displaying their pre-approved amount and three calls to action:

- Generate a pre-approval letter

- Compare mortgage rates

- Confirm “My offer was accepted”

However, only 0.1% of users completed the most critical conversion step: applying for a loan through a lender. A heuristic evaluation revealed two major blockers:

- No visual hierarchy between CTAs: users didn’t know which action mattered most.

- Low perceived value: the dashboard didn’t explain how each action fit into the homebuying journey.

The result: confusion, hesitation, and missed conversion opportunities. Mortgages are high-stakes and emotionally charged, first-time buyers especially need clarity, reassurance, and transparency to move forward confidently.

Problem Details

Credible’s pre-approval dashboard was a critical decision point, but users didn’t know what to do next. Without guidance or personalization, they dropped off, particularly first-time buyers uncertain about the mortgage process.

The Impact

- Only 0.1% of users advanced to the lender application stage

- Users lacked confidence in their next steps

- Educational tools were underused due to unclear value

Opportunity

Redesign the pre-approval dashboard to guide users through a complex decision journey, helping them understand their purchase power, build trust in Credible’s tools, and confidently take the next step.

Why it mattered

Credible’s growth depended on converting early curiosity into qualified applications. For many users, this dashboard was the bridge between research and real borrowing.

By increasing trust and clarity here, Credible could:

- Improve conversion rates from pre-approval to loan application

- Strengthen engagement across early- and late-stage buyers

- Build brand credibility through a more human, educational experience

Goals

- Improve conversion by clarifying next steps toward securing a loan

- Personalize dashboard content based on user intent and readiness

- Reduce decision paralysis by simplifying CTAs

- Increase engagement through interactive, educational tools

- Build long-term trust and repeat intent across user segments

The Research Process

Loan Officer Interviews

Conducted four moderated sessions to understand how borrowers prioritize stages of the mortgage journey and where they most need support or education.

Buyer Interviews & Usability Testing

Interviewed returning homebuyers to understand first-purchase pain points and ran three unmoderated tests with 30 users via UserTesting.com to identify dashboard friction.

Quantitative Validation

Ran a 30-day in-product survey on the pre-approval dashboard (108 users). Results revealed user intent breakdowns:

- 44.4% wanted to browse rates

- 22.2% wanted to know pre-approval amount

- 13.9% wanted a pre-approval letter

- 10.2% wanted to shop for rates

- 6.5% were seeking next steps

- <1% wanted a real estate agent or other options

Key Findings

- Intent matters more than persona: Behavior correlated with readiness stage, not demographics. Tailoring dashboard content by intent yielded better engagement than traditional persona mapping.

- “Dreamers” still deserve value: Nearly 45% of users had low purchase intent but strong curiosity. Lightweight educational tools for this group increased long-term trust and brand familiarity.

- Users need clarity, not more options: Too many CTAs caused hesitation. Simplifying and sequencing actions built confidence.

- Affordability is the emotional driver: Users cared most about understanding monthly payments and trade-offs. Tools visualizing affordability built trust and confidence.

Strategy

We approached the redesign as a system of guided pathways based on user intent.

- Segmentation by readiness: Identified three key states: browsing, preparing, ready to buy, in order to tailor dashboard hierarchy and language.

- Simplified action model: Clarified hierarchy of CTAs to reduce cognitive load and emphasize next best action.

- Personalization & context: Used light personalization and behavioral signals to adjust dashboard copy and layout.

- Education & exploration: Embedded interactive tools to visualize affordability, down payment trade-offs, and local market trends.

- Feedback loop: Integrated live surveys and behavioral analytics to continuously optimize dashboard content.

Solution

Delivered a personalized pre-approval dashboard designed to meet users where they are in the home-buying journey. Key experience features:

- Three tailored dashboard views: browsing, preparing, and ready-to-buy modes

- Context-aware CTAs: adaptive next-step guidance aligned with readiness level

- Interactive tools: dynamic calculators showing how down payment and term choices affect affordability

- Embedded market insights: contextual information about home size, pricing, and payment ranges

- Continuous learning: live surveys and analytics feeding back into dashboard optimization

Outcomes

- Increased return intent: Users revisited the dashboard as intent matured, improving conversion funnel health

- Improved clarity: Users reported higher confidence in understanding their next steps

- Validated direction: Moderated and unmoderated tests confirmed personalization and financial transparency as key trust drivers

- Higher engagement: Early-stage users interacted more with educational features, extending long-term brand relationship

The redesign helped Credible bridge the emotional and practical gaps in the digital mortgage experience, guiding first-time buyers from uncertainty to confidence. By meeting users where they were in their journey, the product strengthened trust, conversion, and engagement across multiple buyer stages.